If you’re a small business owner filing a Schedule C, the answer is probably yes.

Benjamin Franklin is credited with saying, “In this world, nothing can be said to be certain, except death and taxes.” Taxes are an inevitable part of a small business owner’s responsibility, but you may be paying more than you must when you file with the IRS.

That’s the message from Andrea Bone, CPA, Founder and CEO of Accounting and Business Partners, for business owners, especially those just getting started. “Most business owners get their corporate entity and tax filing status confused,” she says. “When you ask them about their company’s tax status, they’ll say ‘I’m an LLC.’” That’s actually the structure your business is registered under in your state; one of the numerous corporate structures you can choose when filing with the state. It’s not your tax filing status with the IRS.

Your tax filing status is determined when you file for your Employer Identification Number (EIN.) Bone goes on to demonstrate how small business owners can save a significant amount of income tax. Here are the steps she walks her clients through.

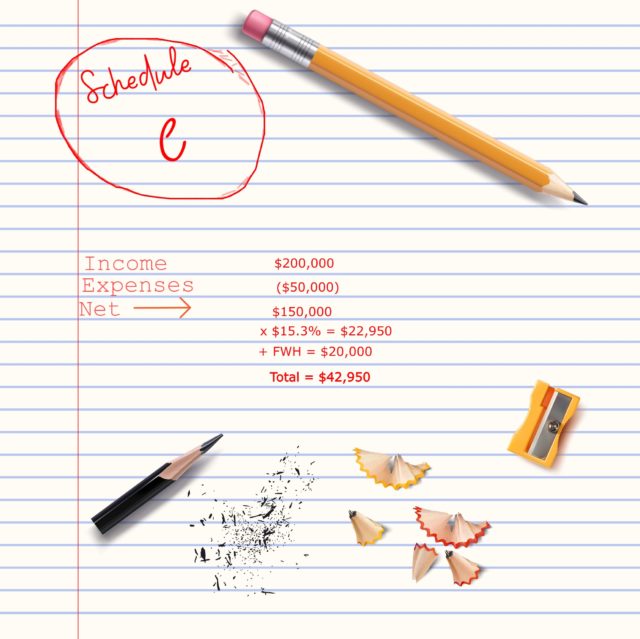

First, it’s important to note that because there is no option to select to be taxed as an S Corporation when you’re initially filing, you’ll automatically be categorized as a Schedule C. If you’re a single-member LLC, that means you’ll always be filing your business return on a Schedule C in your personal income tax filing. As a result, you’ll be paying Social Security and Medicare tax (FICA), otherwise known as self-employment tax, on the net income (revenue – expenses) of your business.

In case you need a refresher, FICA (Federal Insurance Contribution Act) tax is an employee payroll tax that funds Social Security benefits and Medicare health insurance. The tax is split between employers and employees. They both pay 7.65% (6.2% for Social Security and 1.45% for Medicare) of their income to FICA, the combined contribution totaling 15.3%. If you’re self-employed, whether filing as a Schedule C or a S Corporation, you pay both the employer and employee portions of 15.3%. The difference is on what amount you pay the tax.

Let’s take the following examples showing the difference between a Schedule C filer and an S Corporation filer.

Let’s say that you’re a new real estate agent who made $200,000 your first year. You may have some business expenses that add up to $50,000. Your net income will be $150,000. Under a Schedule C status, you’ll pay Social Security and Medicare tax (15.3%) on the net of $150,000, coming to $22,950.

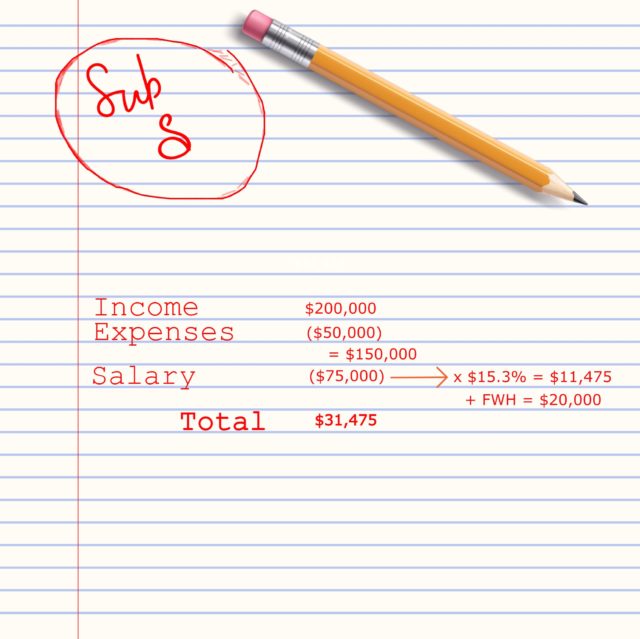

Under an S Corporation status, you take a W2 salary of $75,000, which is taxed for Social Security & Medicare (15.3%) of $11,475, or a savings of 11,475!

|  |

“You must take a salary and issue yourself a W2 to make the S Corporation model work,” Bone says. “Taking distributions out of the business is not the same as taking a salary.” Your salary must be defensible as “reasonable” within the IRS guidelines. In other words, your salary must be comparable to what someone might earn if employed by someone else. “If I’m a CPA, it’s not reasonable to claim a salary of $24,000,” Bone says. “You’ll need to make it closer to your actual market value. But it’s to your advantage to make it as small as you reasonably can since it will be your FICA taxable income.”

Bone is careful to explain that your federal withholding (personal income tax) will still be based on your total taxable income; there’s no way to change that. “But you have enormous control over the amount you pay in Social Security and Medicare payments,” she says. “And why wouldn’t you want to maximize the opportunities available within the tax code”

The advantage becomes significant as the net income of your business increases. Paying a professional to help you to file the proper forms within the required timeline to become an S Corporation and prepare and process your bookkeeping and payroll on a regular basis (monthly or quarterly) will still reap significant savings. Typically, a business with net income over $30,000 is where you’ll start to see a difference.

“There’s no doubt that this can be confusing,” Bone says. “That’s why we sit down with our clients and walk them through the numbers. Once they get it, they’re so glad we did.” If you filed as a Schedule C, as an independent contractor, professional, or small business owner, talk to your tax advisor to see how much you can save on your annual tax bill.

About Andrea Bone:

About Andrea Bone:

Andrea Bone is the Founder & CEO of Accounting & Business Partners. As a hands-on controller for multiple businesses of various sizes from 1995 to 2021, she has been responsible for for all the “back office” operations. Her firm manages accounting, payroll, human resources, taxes, banking, insurance, and legal work. Her favorite part of working with business owner clients is seeing them achieve their goals.

Andrea holds a Bachelor of Science in Accounting from the University of Texas at Dallas and a Master’s degree in Business from Texas A&M University Corpus Christi. She is a Certified Public Accountant and has over 25 years of experience running businesses as a financial controller and CFO.